Shorter Leases v.s. The Profit Motive

In Feb 2012, National Development Minister Khaw Boon Wan had said in a reply to Parliament in January that cutting short the lease of new flats to bring prices down may not be suitable for the needs of young couples. In fact, some young couples were lukewarm about the idea as well. One, who recently bought a Build-to-Order four-room flat in Sengkang for $320,000 and hopes to make at least a 10 per cent profit if they sell it, was quoted as saying:

- "I may pay less for a flat with shorter lease, but I don't want to be stuck with the property which will not be worth much 10 or 20 years down the road."

This profit motive on the part of new flat owners is not unexpected, but it is both unreasonable and unsustainable. It is unreasonable to expect high risk-less returns, and rising housing prices that outstrip income growth impoverish younger generations and are, as such, unsustainable. To see why, first recognize that wages cannot grow faster than the general market, to have housing prices grow faster than that means both high resale profit and increasing unaffordability of housing.

The sale of a flat is termed "unlocking value". That itself is a figure of speech that precisely illustrates inaccessible value that cannot be directly used to achieve market outcomes like starting a business or funding the expansion of an existing one. A mindset shift on the part of Singaporeans must take place. Singaporeans should ask for low-cost housing without the expectation of capital gains, doing so with a mind to using the increased savings for entrepreneurial activity or investment. Singaporeans should expect to apply themselves in order to realize financial gain. This is important for our nation's future.

Pricing Shorter Leases: "Current Methods"

A senior real estate professional, quoted in the Straits Times this month, estimated that the price of a four-room Built-to-Order flat in Punggol with a 99-year lease would fall from $300k to $230k (by about 20%) if its lease were shortened to 60 years, and that the same flat would cost about $140k with a 30 year lease.

At first glance, the reduction in cost is too low to account for the much larger reduction in lease length. These figures were probably furnished to the couples that the Straits Times interviewed. With this in mind, it is retrospectively obvious that none would have been interested in such a raw deal.

Going back to that estimate, if one considers straight line depreciation with no residual value (both flat and land lease), and reads off the total value up to 60 years and 30 years respectively, it turns out that this means a discount rate of about 1.41%. Furthermore, this is uncannily accurate noting that we do have "more equations than unknowns" to work with.

Pricing Shorter Leases: A More Principled Method

It is agreeable the value of the flat should be depreciated over time. Not necessarily linearly, as flats are relatively well maintained in the early years, but the general idea is sound.

On the other hand, I believe that straight line depreciation with discounting should not be the basis the way land is priced. (I recognize that SLA may not actually price in this manner and the numbers might just happen to point to it, but when I see a bird that walks like a duck and swims like a duck and quacks like a duck, I call that bird a duck.)

The basis on which a land lease is priced is the degree to which it deprives other worthy purposes of the use of that land. This is an inherently probabilistic question not unlike those in risk analysis.

It stands to reason that the longer the lease, the more likely that some high value uses beyond the horizon are denied use of that land. Furthermore, it is reasonable to postulate that future land use possibilities would increase in value. In accordance with the history of technological progress, this should be exponential in the distance to the future. (Suggesting a geometric random walk with positive drift. This is geometric growth which is in contrast with the geometric decay of straight line depreciation with discounting.) As such, short leases should carry a disproportionately low price, while long leases should carry disproportionately higher prices. [Edit: An alternate perspective would be to note that the value of land uses grows roughly in tandem with the general stock market, which in turn, on average, grows at a rate much faster than general interest rates which tends to be the ball park of the discount rates used in discounted cash flow analyses.]

There is also a reasonably good analogy to cutting fixed price contracts with suppliers. In this context, one considers risk. Suppliers might be willing to commit to a certain price for a short time frame (say 5 years), but would be unwilling to do so over longer periods like (10 years) unless there is a substantial price premium. This is due to the increasingly higher uncertainty of market conditions as the period of commitment extends farther.

Under "future use/uncertainty pricing", the lease pricing outcome would be the opposite from what arises in straight line depreciation (with discounting over time). With straight-line depreciation and discounting, periods of flat ownership closer to the present day carry a larger portion of the "land cost". Under this principle of pricing, periods of flat ownership closer to the present day carry a smaller portion of the "land cost". (Subsequently, we will term this "Accelerating depreciation".)

This has large implications for the pricing of HDB flats, lease top-up pricing following en-bloc sales, and many other transactions. My interest, however, lies in how this, more principled, approach to pricing land impacts the viability of short tenure flats.

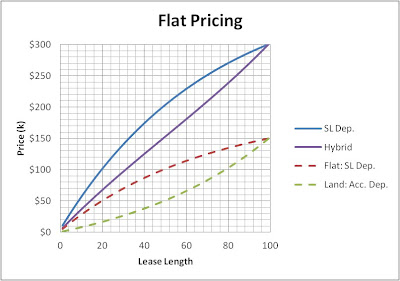

The following diagram illustrates the outcome of such a pricing method. It will be termed Hybrid pricing (Straight Line Depreciation for the flat and "Accelerating" Depreciation for the land) where the intermediate lease is priced. For simplicity, the cost of the flat and the cost of land for the 99-year lease are the same, and the discount rate is the same as the "rate of acceleration" for land depreciation.

Figure 1: Comparison of Lease Pricing Methods

Consulting Figure 1, for 30 year leases, the price of the 4-room BTO flat would be about $97k (compared to $140k), and for 60 year leases the price would be about $180k (compared to $230k). This looks like a much better deal. If the "rate of acceleration" were twice as high, the respective prices would be about $84k and about $159k. (Different rates may be set for different land uses based on historical trends in technology.) [Edit: The graph above presents a "market growth rate" only 1.41% faster than the interest rate. This is a gross underestimate by any account. If the difference were 3%, a 50 year lease would be priced at 20% of the 99 year lease. Why should this be so? Land pricing is about pricing lock-in.]

Given various lease lengths, an average monthly rent is implied. This is shown in Figure 2.

Figure 2: Equivalent Monthly Rentals for Different Lease Pricing Methods

Notably, the main mechanism for the initial decline of the "Average Monthly Rent" is the initial rapid fall in value of the flat (and land in the standard case) due to depreciation and discounting. To reiterate a point made earlier, it does not make much sense to depreciate land.

To briefly digress (to make a polemical statement), studio apartments are 35 sq m to 45 sq m flats costing between $61,000 and $106,000. In contrast, four-room flats typically have a floor area of 90 sq m. Considering the preceding discussion, studio apartments are clearly disproportionately expensive, and it is now somewhat clear why they are priced this way. In view of the foregoing discussion, the present pricing scheme (or the apparent pricing scheme) is one that bilks seniors of their hard earned savings. This is not right.

It should be noted that there is room for confusion in the application of this concept. A partially used lease cannot be reasonably resold on this basis. Ostensibly, it is not equitable if the seller uses the cheaper part of the lease and leaves the buyer with the more expensive part. Examining the matter a bit more deeply, the original basis for pricing the land was, from the perspective of the state, a matter of optimal land use. The tenant of the land has no such considerations, and to him/her the land lease is depreciating capital and may be priced accordingly.

Economic Outcomes

Now, $97k for a 30 year lease is less than 16 months of income for the median household ($6307, including employer CPF contributions, monthly in 2011). For such a household, this is not very much and can be paid off in 3 years comfortably. Relatively early on one's life, one becomes debt free and gains the capacity to take on more debt financing to start a business (for the majority of start-ups that are unable to obtain VC funding).

It is important that people are given the freedom to flex their entrepreneurial muscle when they are young, or they, as many stories of regret will affirm, will find venturing out of their comfort zones too risky when they can. Financial security is a huge concern for a family with children. All things accounted for, the Singapore economy may be losing hundreds of millions in GDP each year due to the new value that would have been created.

Conclusion

A more principled way of pricing land would make shorter lease flats viable. Shorter lease flats would most likely be attractive to those of a more entrepreneurial bent, enabling them to quickly gain the capacity to start business ventures. This would increase the economic vibrancy of Singapore.

While less money would flow into state coffers, increased numbers of people (with some work experience under their belt) will start businesses. Presumably, these people would be aware of the current state of practice, and have enough drive to create businesses that implement better. This will strengthen the economy due to the successive creation of more-productive-than-average businesses.

Increased economic vibrancy has a strongly positive security implication. High productivity means relevance to the world. And relevance is something that we, as a "small resource-poor nation" that is generally represented in red on cartological depictions, cannot do without.

[Edit: In addition, it would be important for the SLA to gain clarity on how to price land using a value-centred approach. Where competition is available in the form of direct competitive bidding that might suffice, but when land is sold to other government agencies for uses like housing and education, then a more nuanced approach is necessary. Anything else might be harmful.]

No comments:

Post a Comment